There are so many reasons why you should learn how to use the CFA financial calculator. Don’t waste time. Before you dive in to studying for the CFA Level 1 exam take a tutorial or book a CFA tutor even if it’s just for one lesson.

In this post, I’m going to take you through some of the most important reasons why, and how it can help.

What CFA Financial Calculator?

Let’s first get on the same page. According to the CFA Institute’s Calculator Policy there are two different types of calculators a candidate can use to take the exam:

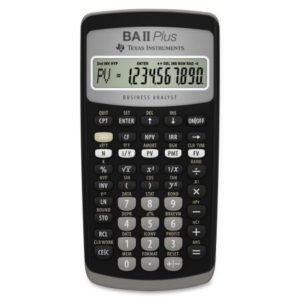

- Texas Instruments BA II Plus (including BA II Plus Professional)

- Hewlett Packard 12C (including the HP 12C Platinum, 12C Platinum 25th anniversary edition, 12C 30th anniversary edition, and HP 12C Prestige)

If you have any other calculator than the above two you will not be allowed to take the exam. Be prepared.

Both calculators perform the same functions but most people go with the Texas Instruments BA II Plus. It’s easy to use, has a familiar look and feel, and will last you a long time. If you already have the HP 12C, don’t fret. It’s just as capable as the Texas Instruments calculator. For each of them, the important thing is that you get to know how they work!

There Aren’t That Many Quant Questions, Will the CFA Financial Calculator Actually Help Me?

In short, yes. The questions with which you can use the calculator will be significantly less time consuming with one of the CFA financial calculators. For example, below is the formula for the present value of an ordinary annuity.

PV = A * [ (1+r) N -1 ]

[ r ]

Instead of having to remember that, if you can recognize that you need to solve for “PV” then you can use the calculator: Imagine a scenario where you want to end up with $200M in 20 years time after making annual payments of $6M with a discount rate of 4%. Rather than having to memorize the above formula, or understand the math that leads to it, you just have to know how to solve for PV on your CFA financial calculator.

- FV = 200 FV [ENTER]

- PMT = 6 PMT [ENTER]

- I/Y = 4 I/Y [ENTER]

- N = 20 N [ENTER]

- CPT PV

The same can be done for any future value or present value scenarios. Many of my students from Professional Exam Tutoring get stuck when it comes to exponents, fractions, and interest rates. To save yourself the hassle of figuring out what numbers go where in a formula, just know where they go for the calculator.

Brackets…Use Them

One of the biggest complaints I hear is that there is no memory function. It’s true. The CFA financial calculators do not allow for storing any numbers you might be using for a problem. The solution to this is the use of “( )” (brackets). Review BEDMAS from high school and make sure you put brackets to use in the right spots so that your formulas can be done on your calculator all in one shot. This will also save you seconds, which over the course of the exam can turn into minutes – which can of course mean extra points if you are able to get through more questions that way!

Lastly, keep in mind that the CFA financial calculator can take some time to learn. Try to learn how to use them early. The longer you have practice with them, the better. I offer a whole tutorial on the CFA financial calculator in my in-person and online CFA tutoring sessions. If there is one thing I can’t recommend enough, it is getting to know the calculator!